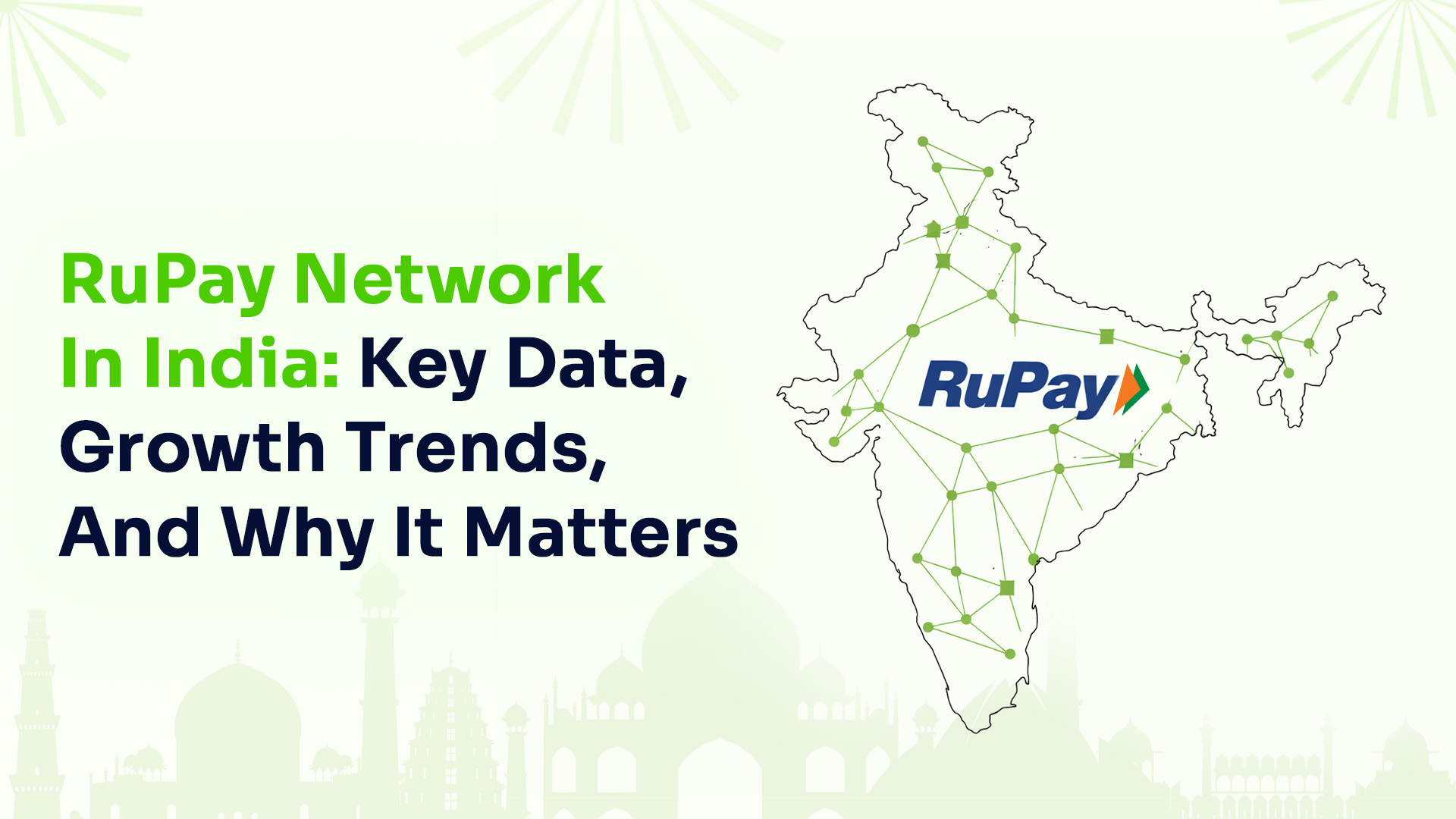

RuPay is India’s indigenous card payment network, created by the National Payments Corporation of India (NPCI) in 2012. It supports debit, credit, prepaid and international payments on domestic rails.

RuPay debit cards are issued by banks to their customers to access savings and current accounts, ATM withdrawals, and merchant payments.

Timeline of Growth — RuPay Debit Cards (Issued / Market Share)

Early Years (Pre-2016)

- RuPay launched in 2012.

- In the early years, issuance was modest as the network was being built.

2016 – Rapid Expansion

- By 2016, RuPay debit cards were ramping up, partly driven by financial inclusion initiatives like Pradhan Mantri Jan Dhan Yojana (PMJDY).

2018 – Surge in Issuance

- As of November 2018, India had issued ~560 million (56 crore) RuPay cards — a jump from roughly 230 million in 2016.

- This massive rise was driven by bank onboarding and the Jan Dhan programme.

During this period, RuPay’s market share in total cards issued grew sharply from tiny (single digits) to about 50% of all debit + credit cards in India by 2018.

2020 – 600+ Million Cards Issued

- By November 2020, more than 600 million RuPay cards had been issued by banks in India.

Most of these were debit cards. Wikipedia

2021 – PMJDY Contribution

- As of December 2021, 31.17 crore (311.7 million) RuPay debit cards had been issued under PMJDY accounts alone.

This shows the continued push via financial inclusion programs. Press Information Bureau

2024 – Further Growth

- NPCI data indicates that as of mid-2024, over 36.68 crore RuPay debit cards had been issued under PMJDY.

This excludes the many RuPay debit cards issued outside that scheme, implying total issuance well above 400 million. TaxIndiaOnline

2025 – Latest Estimates

- Although NPCI hasn’t released full consolidated year-end figures yet, RuPay remains the dominant debit card brand in India with the majority share of cards issued.

Global and RBI reports indicate total debit card volumes (all networks) in India at ~120–130 crore per month as of early 2025, implying RuPay debit issuance is still very high. CEIC Data

Note: Official NPCI card counts include debit, credit, prepaid and business cards. Historical data shows debit makes up the bulk.

Key Factors Behind Growth

Government Financial Inclusion Policy

- Through PMJDY, millions of previously unbanked people opened bank accounts — and were issued RuPay debit cards by default. Press Information Bureau

Low Cost & Domestic Push

- RuPay’s low fees for banks and merchants helped quick adoption.

- Mandatory zero MDR on many RuPay transactions under government policy boosted merchant acceptance.

Infrastructure Expansion

- Banks across India — public and private — issued RuPay cards to customers of all segments. Over 1,100+ banks were issuing RuPay by 2020.

Shift Toward Digital Payments

- While UPI has taken the lead in daily payments, RuPay debit cards remain important for ATM access, online spending, and fallback payment method.

Current Usage Trends & Observations (2026)

Still High Issuance

- RuPay continues to dominate debit card issuance — most new savings accounts in India still yield a RuPay debit card.

Shift in Usage

- Recent payment behaviour studies show UPI overtaking debit cards in low-ticket everyday transactions, pushing debit cards more toward ATM and specific POS use.

Debit Cards Still Relevant

- Debit cards remain widely used for:

- ATM cash withdrawals

- Online shopping

- Banking platform payments (non-UPI)

…especially for users and merchants who prefer card rails over UPI.

Summary — Growth Story in Numbers

| Year / Milestone | RuPay Debit Cards Issued | Key Insights |

| 2012 (Launch) | Minimal | New network introduction Wikipedia |

| 2016 | ~230 million | Early shoot-up due to policy push Wikipedia |

| 2018 | ~560 million | Rapid onboarding, strong market share Wikipedia |

| 2020 | ~600+ million | More banks onboarded Wikipedia |

| 2021 (PMJDY) | 311.7 million PMJDY cards | Major inclusion impact Press Information Bureau |

| 2024 (PMJDY) | 366.8 million PMJDY cards | Continued growth under inclusion programs TaxIndiaOnline |

| 2025 (Estimated) | ~700m+ total debit cards | RuPay dominant debit issuer (incl. outside PMJDY) Wikipedia |

(Figures may include overlapping categories — detailed NPCI monthly data breaks this down further.)

Why This Matters

RuPay debit card growth shows India’s progress toward formal financial systems. Cards now reach urban and rural users alike. They complement UPI, giving users multiple digital payment options. They offer financial access to new bank customers.

This growth ties into digital economy expansion, financial inclusion, and retail digitisation across India.